For most, the home purchase represents the biggest transaction someone will ever make. And while the Search phase is a ton of fun, it ties in to a set of processes that involve important decisions that need to be made, events that need to be scheduled, coordinated and managed, and people in several capacities who need to perform. Getting your arms around all of the moving parts can be a real challenge. But you have us ON YOUR SIDE! Read on to get educated on the process.

First, who are the players?

Here are the Key Professionals Involved in Your Transaction:

REALTOR®

A REALTOR® is a licensed real estate agent and a member of the National Association of REALTORS? a real estate trade association. REALTORS® also belong to their state and local Association of REALTORS”

REAL ESTATE AGENT

A real estate agent is licensed by the state to represent parties in the transfer of property. Every REALTOR” is a real estate agent, but not every real estate agent has the professional designation of a REALTORS®

LISTING AGENT

A key role of the listing agent or broker is to form a legal relationship with the homeowner to sell the property and place the property in the Multiple Listing Service.

BUYER’S AGENT

A key role of the buyer’s agent or broker is to work with the buyer to locate a suitable property and negotiate a successful home purchase.

MULTIPLE LISTING SERVICE (MLS)

The MLS is a database of properties listed for sale by REALTORS® who are members of the local Association of REALTORS” Information on an MLS property is available

to thousands of REALTORS?

TITLE COMPANY

These are the people who carry out the title search and examination, work with you to eliminate the title exceptions you are not willing to take subject to, and provide the policy of title insurance regarding title to the real property.

ESCROW OFFICER

An escrow officer leads the facilitation of your escrow, including escrow instructions preparation, document preparation, funds disbursement, and more.

What is a REALTOR, and why should I use one?

Congratulations on your decision to buy a home! It’s a challenging project, and there are many ways a professional can help. Here are some of the many ways you may benefit from working with a REALTOR®:

IT WON’T COST YOU ANYTHING OUT-OF-POCKET!

The fees paid to a REALTOR® who helps you buy a home is usually baked into the price of the home.

MANY MORE HOME CHOICES.

Your REALTOR”‘ has thousands of homes to choose from through the Multiple Listing Service (MLS), so you’re more likely to find the home that’s just right for you and find it quicker. In fact, a majority of the homes for sale are listed by REALTORS® and aren’t available to you unless you are working with a REALTOR”‘

A NUMBER OF TRANSACTIONS “FALL OUT.”

Unfortunately, it’s true. Some transactions fall apart before closing. An experienced REALTOR® may be able to resolve problems and see your transaction through to a successful closing.

KNOWLEDGE OF NEW HOME SUBDIVISIONS.

New home subdivisions will welcome you and your REALTOR® If you’re interested in buying a new home, take your agent with you on your first visit to each subdivision. Your professional REALTOR® is an important source of information who can supply background on the builder, nearby subdivisions, and the local community.

IT’S A MAJOR INVESTMENT.

You use a professional for your legal, financial and health needs. Why gamble on what may be your biggest investment without a professional at your side?

HELP WITH FSBO’S.

If you consider a “For Sale By Owner,” take your REALTOR® along to help negotiate the contract.

LESS LIABILITY.

You may have more protection from legal and financial liability, especially as real estate transactions become more complicated.

THE PAPERWORK.

Your experienced REALTOR® will negotiate and prepare the purchase contract for you and assist you throughout the escrow process.

What mistakes should I avoid?

AVOID CHANGING JOBS

A job change may result in your loan being denied, particularly if you are taking a lower-paying position or moving into a different field. Don’t think you’re safe because you’ve received approval earlier in the process, as the lender may call your employer to re-verify your employment just prior to funding the loan.

AVOID SWITCHING BANKS OR MOVING YOUR

MONEY TO ANOTHER INSTITUTION

After the lender has verified your funds at one or more institutions, the money should remain there until needed for the purchase.

AVOID PAYING OFF EXISTING ACCOUNTS

UNLESS YOUR LENDER REQUESTS IT

If your loan officer advises you to pay off certain bills in order to qualify for the loan, follow that advice. Otherwise, leave your accounts as they are until your escrow closes.

AVOID MAKING ANY LARGE PURCHASES

A major purchase that requires a withdrawal from your verified funds or increases your debt can result in your not qualifying for the loan. A lender may check your credit or re-verify funds at the last minute, so avoid purchases that could impact your loan approval.

What is a “pre-qual” and why is it so important?

Before you begin your dream home search in earnest, you must have your financial ducks lined up. How much house can I afford? What will my payments be? In this phase, you are working with a lender who will look at your financial docs (W2s, bank statements, etc) to help you understand what you can afford and what they are willing to loan. The lender will provide your agent with a pre-qual document with all the information needed to go along with any offer you decide to make. It is part of what the seller will need to consider your offer.

How do I get a loan?

WHEN AND WHERE TO APPLY FOR A LOAN? There are many sources for home loans including banks, credit unions, mortgage companies, and mortgage brokers. Your REALTOR® may give you several names of lenders who have proven reliable in their previous transactions. Apply for your loan as soon as possible. A lender will prequalify you for a certain price range and help you avoid disappointment later.

YOUR LENDER WILL MAIL OUT VERIFICATION REQUESTS and order an appraisal on the property you are buying. If your lender asks for additional items, please comply promptly with those requests to avoid delaying loan approval.

WHAT IS HAZARD (OR FIRE) INSURANCE? Hazard insurance covers the dwelling itself and is required by the lender to protect their “risk” in your home. Your lender will explain the necessary hazard insurance coverage to you. If you are buying a condominium, a master policy already exists which includes your unit-but it does not cover your personal belongings.

CONTACT YOUR INSURANCE AGENT EARLY in the process, because this coverage must be provided so the lender can release loan funds. Hazard insurance is one of the items frequently postponed until the last minute, and this can result in delaying the closing for a day or more. Order your insurance as soon as your loan is approved; then furnish your escrow officer with the agent’s name and phone number. When you talk with your insurance agent, be sure to ask about additional coverage in a homeowner’s policy to insure your personal belongings and to protect against liability for such events as injuries to visitors.

WHAT HAPPENS AFTER LOAN APPROVAL?

After loan approval and just prior to your planned closing date, the lender will send loan documents to Title, and your escrow officer will prepare an estimated settlement statement. This statement indicates what funds go where, and at this time your escrow officer can tell you how much money you need to bring to the closing appointment. Be aware that this amount may be higher or lower than previously estimated due to changes in such items as prepaid interest, prorated fees, courier fees, and impound accounts.

Making an Offer

So you found a home you really want and area ready to make an offer. Awesome! Here’s what the process looks like:

- We will prepare your offer which will include several documents for you to sign. We will review them together prior to submitting. There will be a Residential Resale Real Estate Purchase Contract, the Pre-Qualifications Form, and perhaps some necessary Addendum like the HOA Condo/Planned Community Addendum are all sent to the seller via their agent.

- The sellers have a deadline that we set for them to respond. They can:

- Accept the offer as is

- Reject the offer

- Counter the offer. If they counter, then we have a certain amount of time to Accept their counter, Reject it, or Counter it again. If at any point either party does not respond by the expiration date/time, then the offer is considered Rejected.

- When we have an agreement both have accepted, then we are “under contract” and the property is marked “active contingent” in MLS. People can still look at the home, but offers cannot be accepted.

Offer Accepted- what’s next?

Holy Cow! You have found the right home, tendered an offer and it was accepted! You are “under contract”! Here’s what happens next:

- Inspections

- The day AFTER the agreement is signed by both parties, we enter 10-day inspection period. We will coordinate everything. You can decide which home inspector, termite inspector, roof inspector and sewer inspector you want. We have a list of people we have used for years, but you can use anyone you want. We meet with the inspectors (and you can be there too to hear first-hand what they are reporting) and you pay them. We will get reports from each inspector, then decide what, if anything, we want to ask the seller to address in order to keep moving forward.

- If we ask for repairs to be completed, or if we want to ask for a price reduction instead of repairs, we do that in the 10-day period on a BINSR. (Buyer Inspection Notice and Seller’s Response.) We submit the BINSR, and they have 5 days to respond. They can agree to address the issues or state they will NOT address the issues. If they agree to address the issues, then the 10-day inspection period is over even if it’s not been 10 days. If they say they will not address the issues, you have 5 days to either accept that or cancel the contract.

- Appraisal

- Once we know we’re still moving forward, your Lender orders the appraisal. You pay for it when it is ordered, but we can also ask for it to be baked in to your closing costs. The appraisal will come back with a value determination and possibly some required repairs. If the value determination is the same as the price you’re paying, then great. If the appraisal comes in low, we may have to ask the price be lowered to match the appraised value. Either buyer or seller can cancel the deal if appraisal is low. And for VA, any repairs they call out must be completed in order for the loan to be funded. Usually the seller pays for those repairs, but again, they can cancel the deal if they want.

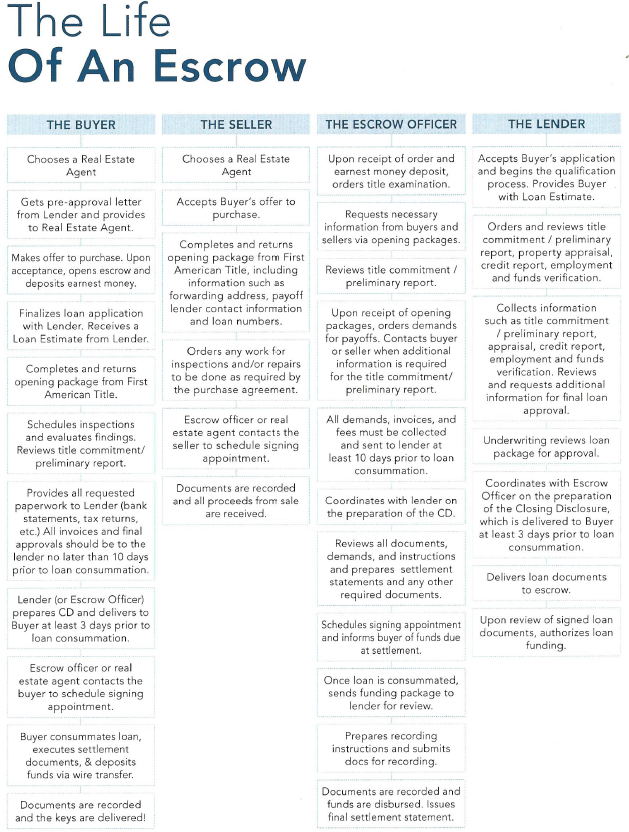

What is Escrow, and how does it all work?

What is an Escrow? The escrow is the process of havinga neutral party manage the exchange of money for real property. The escrow holder is known as an escrow or settlement officer or agent. The buyer deposits funds and the seller deposits a deed with the escrow holder along with other documents required to remove all “contingencies” (conditions and approvals) in the purchase agreement prior to closing

How is an Escrow Opened? Once a purchase agreement is signed by all necessary parties, the agent representing the party who will pay the fee selects an escrow holder and the buyer’s earnest money deposit and contract are submitted to the escrow holder. From this point, the escrow holder will follow the manual written instructions of the buyer and seller, maintaining a neutral stance to ensure that neither party has an unfair advantage over the other. The escrow holder also follows the instructions of the Buyer’s new lender, the seller’s existing lender, and both parties’ agents. The escrow holder ensures the transparency of the transaction, while carefully maintaining the privacy of consumers.

What things will the escrow officer do?

> Open escrow and, if instructed to do so, deposit your good faith funds in a separate escrow account

> Order a title search to determine ownership and status of the subject real property

> Issue a preliminary report and begin the process of eliminating the title exceptions you and your lender are not willing to take title subject to

> Request payoff information for the seller’s loans, other liens, homeowner’s association fees, etc.

> Coordinate with the buyer’s lender on the preparation of the Closing Disclosure (CD)

> Prorate fees, such as real property taxes, per the contract, and prepare the settlement statement

> Set separate appointments allowing the seller and you to sign documents and deposit funds

> Review documents ensuring all conditions and legal requirements are fulfilled; request funds from lender

> When all funds are deposited, record documents with the County Recorder’s Office to transfer the subject real property to you

> After the recordation is confirmed, close escrow and disburse funds, including Seller’s proceeds, loan payoffs, etc.

> Prepare and send final documents to all parties involved

The overall escrow flow

Choosing how you will hold Title

It is important to understand the different methods to hold title, as it’s a decision you must make on your own. You should inform your escrow officer and lender as soon as possible of how you wish to hold title to your home and exactly how your name(s) will appear on all documents. This allows your lender and title company to prepare all documents correctly. (Changes later, such as adding or deleting an initial in your name, can delay your closing.) You may wish to consult an attorney, accountant or other professional before deciding how to hold title. Here’s a breakdown on the 4 methods:

Community Property

> Requires a valid marriage between two persons.

> Each spouse holds an undivided one-half interest in the estate.

> One spouse cannot partition the property by selling his or her interest.

> Requires signatures of both spouses to convey or encumber.

> Each spouse can devise (will) one-half of the community property.

> Upon death the estate of the decedent must be “cleared” through probate, affidavit or adjudication.

> Both halves of the community property are entitled to a “stepped up” tax basis as of the date of death.

JOINT TENANCY WITH RIGHT OF SURVIVORSHIP

> Parties need not be married; may be more than two joint tenants.

> Each joint tenant holds an equal and undivided interest in the estate, unity of interest.

> One joint tenant can partition the property by selling his or her joint interest.

> Requires signatures of all joint tenants to convey or encumber the whole.

> Estate passes to surviving joint tenants outside of probate

> No court action required to “clear” title upon the death of joint tenant(s).

> Deceased tenant’s share is entitled to a “stepped up” tax basis as of the date of death.

COMMUNITY PROPERTY WITH RIGHT OF SURVIVORSHIP

> Requires a valid marriage between two persons.

> Each spouse holds an undivided one-half interest in the estate.

> One spouse cannot partition the property by selling his or her interest.

> Requires signatures of both spouses to convey or encumber.

> Estate passes to the surviving spouse outside of probate.

> No court action required to “clear” title upon the first death.

> Both halves of the community property are entitled to a “stepped up” tax.

TENANCY IN COMMON

> Parties need not be married; may be more than two tenants in common.

> Each tenant in common holds an undivided fractional interest in the estate. Can be disproportionate, e.g.,20% and 80%; 60% and 40%; 20%, 20%, 20% and 40%; etc.

> Each tenant’s share can be conveyed, mortgaged or devised to a third party.

> Requires signatures of all tenants to convey or encumber the whole.

> Upon death the tenant’s proportionate share passes to his or her heirs by will or intestacy.

> Upon death the estate of the decedent must be “cleared” through probate, affidavit or adjudication.

> Each share has its own tax basis.

What is Title Insurance?

Prior to the development of the title industry in the late 1800s, a home-buyer received a grantor’s warranty, attorney’s title opinion, or abstractor’s certificate as assurance of home ownership. The buyer relied on the financial integrity of the grantor, attorney, or abstractor for protection. Today, home-buyers look primarily to title insurance to provide this protection. Title insurance companies are regulated by state statute. They are required to post financial guarantees to ensure that any claims will be paid in a timely fashion. They also must maintain their own “title plants” which house duplicates of recorded deeds, mortgages, plats, and other pertinent county property records.

WHAT IS TITLE INSURANCE? Title insurance provides coverage for certain losses due to defects in the title that, for the most part, occurred prior to your ownership. Title insurance protects against defects such as prior fraud or forgery that might go undetected until after closing and possibly jeopardize your ownership and investment.

WHY IS TITLE INSURANCE NEEDED? Title insurance insures buyers against the risk that they did not acquire marketable title from the seller. It is primarily designed to reduce risk or loss caused by defects in title from the past. A loan policy of title insurance protects the interest of the mortgage lender, while an owner’s policy protects the equity of you, the buyer, for as long as you or your heirs (in certain policies) own the real property.

WHEN IS THE PREMIUM DUE? You pay for your owner’s title insurance policy only once, at the close of escrow. Who pays for the owner’s policy and loan policy varies depending on local customs.

The Importance of Title Protection There are many title issues that could cause you to lose your real property or your mortgage investment. Even the most careful search of public records may not disclose the most dangerous threat: hidden risks. These issues may not be uncovered until years later. Without title insurance from a reputable and financially solvent company, the ownership of your home could be jeopardized.

Here are some examples of title issues that may occur:

- Deeds by persons supposedly single, but secretly married

- Deeds in lieu of foreclosure given under duress

- Marital rights of spouse purportedly, but not legally, divorced

- Impersonation of the true owner of the land Deeds by minors

- Deeds by persons of unsound mind

- Deeds to or from defunct corporations

- Defective acknowledgments by notaries

- Duress in execution of instruments

- Erroneous reports furnished by tax officials

- Forged deeds, releases, etc.

- Mistakes in recording legal documents

- Surviving children omitted from will

- Administration of estate of persons absent but not deceased Birth or adoption of children after date of will

- Claims of creditors against real property sold by heirs or devisees Deed of community proper

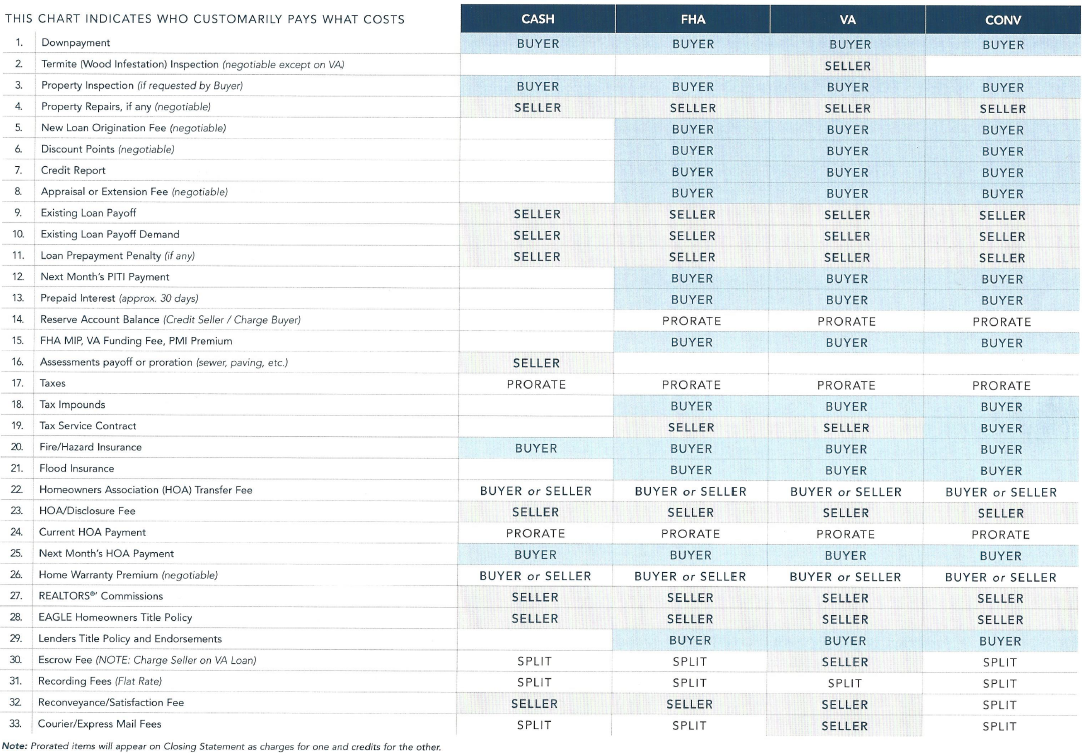

Closing Costs- what are the numbers?

How to Close Escrow

THE CLOSING DISCLOSURE

Once the loan is approved and all invoices and paperwork have been provided, the lender and escrow officer will collaborate on the preparation of the Closing Disclosure (CD). In order to close on time, all paperwork and invoices should be submitted at least 10 days prior to the expected close of escrow date. The borrower must receive the CD at least three days* prior to consummation of the loan (typically the signing date). The escrow officer will also prepare an estimated settlement statement and inform the buyer of the balance of the down payment and closing costs needed to close escrow.

THE CLOSING OR SIGNING APPOINTMENT

The escrow holder will contact you or your agent to schedule a closing or signing appointment. In some states, this is the “close of escrow.” In some others, the close of escrow is either the day the documents record or that funds are disbursed. Ask your escrow holder if you would like clarification about your state’s laws.

You will have a chance to review the settlement statement and supporting documentation. This is your opportunity to ask questions and clarify terms. You should review the settlement statement carefully and report discrepancies to the escrow officer. This includes any payments that may have been missed. You are responsible for all charges incurred even if overlooked by the escrow holder, so it’s better to bring these to their attention before closing.

The escrow holder is obligated by law to have the designated amount of money before releasing any funds. If you have questions or foresee a problem, let your escrow holder know immediately.

DON’T FORGET YOUR IDENTIFICATION

You will need valid identification with your photo I.D. on it when you sign documents that need to be notarized (such as a deed). A driver’s

license is preferred. You will also be asked to provide your social security number for tax reporting purposes, and a forwarding address.

WHAT HAPPENS NEXT?

If you are obtaining a new loan, your signed loan documents will be returned to the lender for review. The escrow holder will ensure that all contract conditions have been met and will ask the lender to “fund the loan.” If your loan documents are satisfactory, the lender will send funds directly to the escrow holder. When the loan funds are received, the escrow holder will verify that all necessary funds are in. Escrow funds will be disbursed to the seller and other appropriate payees. Then, you’ll receive the keys to your home!

After The Closing

We recommend you keep all records pertaining to your home together in a safe place, including all purchase documents, insurance, maintenance, and improvements.

HOME WARRANTY REPAIRS

If you have a home warranty plan with First American Home Buyers Protection, please call them directly and have your home warranty number available.

RECORDED DEED

The original deed to your home will be mailed directly to you by the County Recorder, generally within four to six weeks.

TITLE INSURANCE POLICY

First American Title will mail your policy to you in about two to three weeks.

PROPERTY TAXES

You may not receive a tax statement for the current year on the home you buy; however, it is your obligation to make sure the taxes are paid when due. Check with your mortgage company to find out if taxes are included with your payment. For more information on your property taxes, visit your County Auditor/Controller’s web site.

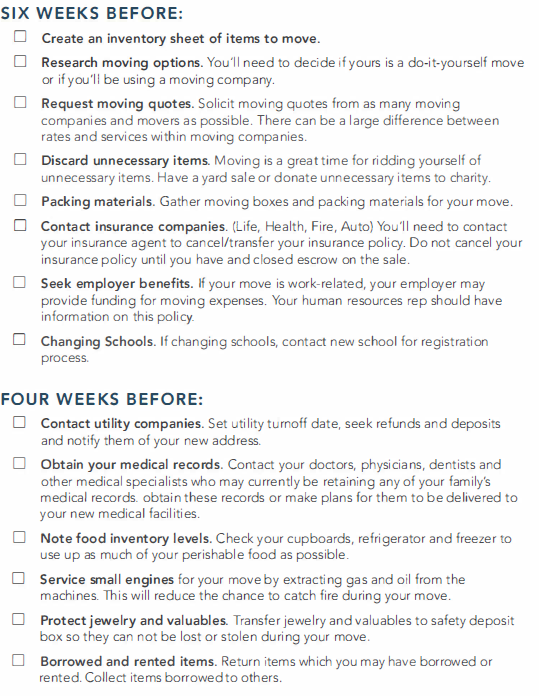

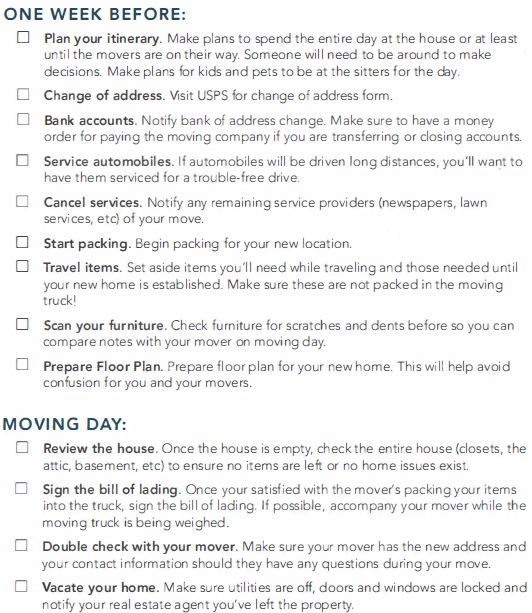

Planning Your Move

Signing Day!

So now you’ve gone through almost the entire process and it’s finally the big day!

- You may actually sign your documents in advance of closing day. You will go to the Title company, or they will send a notary to you. You will hand Title a check or arrange wire transfer for whatever fees you owe (you will know that in advance). You will have your driver’s license so the notary can record your official signatures.

- Usually around 5pm on the actual COE day, the Title will record so the property is officially in your name, and all of the funds get dispersed. All of the costs outlined above get settled.

- And then I give you the keys!

Content provided by First American Title. ©First American Title Corporation and/or its affiliates. All rights reserved.