There are more than 50 tasks, objectives and deliveries involved in taking a seller side transaction from contract through a successful closing. But you have us ON YOUR SIDE and we’re on top of all of them to make sure you leave the closing table with a check to move on with life. Read on to get educated on the process.

First, who are the players?

Here are the Key Professionals Involved in Your Transaction:

REALTOR®

A REALTOR® is a licensed real estate agent and a member of the National Association of REALTORS? a real estate trade association. REALTORS® also belong to their state and local Association of REALTORS”

REAL ESTATE AGENT

A real estate agent is licensed by the state to represent parties in the transfer of property. Every REALTOR” is a real estate agent, but not every real estate agent has the professional designation of a REALTORS®

LISTING AGENT

A key role of the listing agent or broker is to form a legal relationship with the homeowner to sell the property and place the property in the Multiple Listing Service.

BUYER’S AGENT

A key role of the buyer’s agent or broker is to work with the buyer to locate a suitable property and negotiate a successful home purchase.

MULTIPLE LISTING SERVICE (MLS)

The MLS is a database of properties listed for sale by REALTORS® who are members of the local Association of REALTORS” Information on an MLS property is available

to thousands of REALTORS?

TITLE COMPANY

These are the people who carry out the title search and examination, work with you to eliminate the title exceptions you are not willing to take subject to, and provide the policy of title insurance regarding title to the real property.

ESCROW OFFICER

An escrow officer leads the facilitation of your escrow, including escrow instructions preparation, document preparation, funds disbursement, and more.

What is a REALTOR, and why should I use one?

Before you make the decision to try to sell your home alone, consider the benefits a REALTOR® can provide that you may not be aware of.

A REALTOR®:

> Understands market conditions and has access to information not available to the average homeowner.

> Can advertise effectively for the best results.

> Knows how to price your home realistically, to give you the highest price possible within your time frame.

> I s experienced in creating demand for homes and how to show them to advantage.

> Knows how to screen potential buyers and eliminate those who can’t qualify or are looking for bargain-basement prices.

> Knows how to go toe-to-toe in negotiations.

> Is always “on-call,” answering the phone at all hours, and showing homes evenings and weekends.

> Can remain objective when presenting offers and counter-offers on your behalf.

> Maintains errors-and-omissions insurance.

> Will listen to your needs, respect your opinions and allow you to make your own decisions.

> Can help protect your rights, particularly important with the increasingly complicated real estate laws and regulations.

> I s experienced with resolving problems to facilitate a successful closing on your home.

Preparing Your Home

First impressions have a major impact on potential buyers. Try to imagine what potential buyers will see when they approach your house for the first time and walk through each room. Ask your REALTOR® for advice; they know the marketplace and what helps a home sell. Here are some tips to present your home in a positive manner:

Mow and edge the lawn regularly, and trim the shrubs.

Make your entry inviting: Paint your front door and buy a new front door mat.

Paint or replace the mailbox, if needed.

If screens or windows are damaged, replace or repair them.

Repair or replace worn shutters and other exterior trim.

Make sure the front steps are clear and hazard-free. Make sure the doorbell

works properly and has a pleasant sound.

Ensure that all exterior lights are working.

Check stucco walls for cracks and discoloration.

Remove any oil and rust stains from the driveway and garage.

Clean and organize the garage, and ensure the door is in good working order.

Shampoo carpeting or replace if worn. Clean tile floors, particularly the caulking.

Brighten the appearance inside by painting walls, cleaning windows and window coverings, and removing sunscreens.

Repair leaky faucets and caulking in bathtubs and showers.

Repair or replace loose knobs on doors and cabinets. If doors stick or squeak, fix them. Make sure toilet seats look new and are firmly attached.

Repair or replace loud ventilating fans.

Replace worn shower curtains.

Rearrange furniture to make rooms appear larger. If possible, remove and/or store excess furniture, and avoid extension cords in plain view.

Remove clutter throughout the house. Organize and clean out closets.

Clean household appliances and make sure they work properly.

Air conditioners/heaters, evaporative coolers, hot water heater should be clean, working and inspected if necessary. Replace filters.

Check the pool and/or spa equipment and pumps. Make sure all are working properly and that the pool and/or spa are kept clean.

Inspect fences, gates and latches. Repair or replace as needed.

Staging to Show & Sell

Keep everything clean. A messy or dirty home will cause prospective buyers to notice every flaw.

Clear all clutter from counter tops.

Let the light in. Raise shades, open blinds, pull back the curtains and turn on the lights.

Get rid of odors such as tobacco, pets, cooking, etc., but don’t overdo air fresheners or potpourri. Fresh baked bread and cinnamon can make a positive impact.

Send pets away or secure them away from the house, and be sure to clean up after them. Close the windows to eliminate street noise.

If possible you, your pets, and your children should be gone while your home is being shown.

Clean trash cans and put them out of sight.

If you must be present while your home is shown, keep noise down.

Turn off the TV and radio. Soft, instrumental music is fine, but avoid vocals.

Keep the garage door closed and the driveway clear. Park autos and campers away from your home during showings

Hang clean attractive guest towels in the bathrooms.

Check that sink and tub are scrubbed and unstained.

Make beds with attractive spreads.

Stash or throw out newspapers, magazines, junk mail.

What is Escrow, and how does it all work?

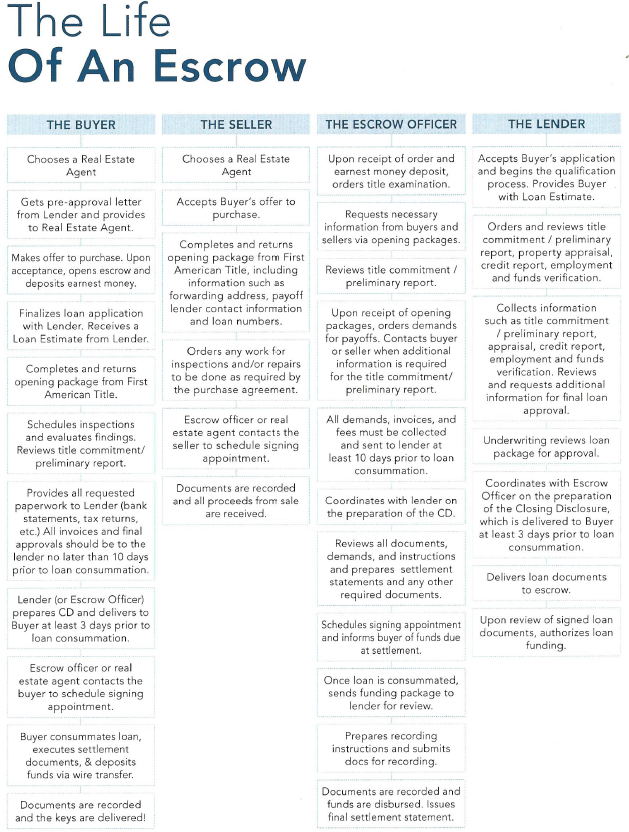

What is an Escrow? The escrow is the process of havinga neutral party manage the exchange of money for real property. The escrow holder is known as an escrow or settlement officer or agent. The buyer deposits funds and the seller deposits a deed with the escrow holder along with other documents required to remove all “contingencies” (conditions and approvals) in the purchase agreement prior to closing

How is an Escrow Opened? Once a purchase agreement is signed by all necessary parties, the agent representing the party who will pay the fee selects an escrow holder and the buyer’s earnest money deposit and contract are submitted to the escrow holder. From this point, the escrow holder will follow the manual written instructions of the buyer and seller, maintaining a neutral stance to ensure that neither party has an unfair advantage over the other. The escrow holder also follows the instructions of the Buyer’s new lender, the seller’s existing lender, and both parties’ agents. The escrow holder ensures the transparency of the transaction, while carefully maintaining the privacy of consumers.

What things will the escrow officer do?

> Open escrow and, if instructed to do so, deposit your good faith funds in a separate escrow account

> Order a title search to determine ownership and status of the subject real property

> Issue a preliminary report and begin the process of eliminating the title exceptions you and your lender are not willing to take title subject to

> Request payoff information for the seller’s loans, other liens, homeowner’s association fees, etc.

> Coordinate with the buyer’s lender on the preparation of the Closing Disclosure (CD)

> Prorate fees, such as real property taxes, per the contract, and prepare the settlement statement

> Set separate appointments allowing the seller and you to sign documents and deposit funds

> Review documents ensuring all conditions and legal requirements are fulfilled; request funds from lender

> When all funds are deposited, record documents with the County Recorder’s Office to transfer the subject real property to you

> After the recordation is confirmed, close escrow and disburse funds, including Seller’s proceeds, loan payoffs, etc.

> Prepare and send final documents to all parties involved

The overall escrow flow

What is Title Insurance?

Prior to the development of the title industry in the late 1800s, a home-buyer received a grantor’s warranty, attorney’s title opinion, or abstractor’s certificate as assurance of home ownership. The buyer relied on the financial integrity of the grantor, attorney, or abstractor for protection. Today, home-buyers look primarily to title insurance to provide this protection. Title insurance companies are regulated by state statute. They are required to post financial guarantees to ensure that any claims will be paid in a timely fashion. They also must maintain their own “title plants” which house duplicates of recorded deeds, mortgages, plats, and other pertinent county property records.

WHAT IS TITLE INSURANCE? Title insurance provides coverage for certain losses due to defects in the title that, for the most part, occurred prior to your ownership. Title insurance protects against defects such as prior fraud or forgery that might go undetected until after closing and possibly jeopardize your ownership and investment.

WHY IS TITLE INSURANCE NEEDED? Title insurance insures buyers against the risk that they did not acquire marketable title from the seller. It is primarily designed to reduce risk or loss caused by defects in title from the past. A loan policy of title insurance protects the interest of the mortgage lender, while an owner’s policy protects the equity of you, the buyer, for as long as you or your heirs (in certain policies) own the real property.

WHEN IS THE PREMIUM DUE? You pay for your owner’s title insurance policy only once, at the close of escrow. Who pays for the owner’s policy and loan policy varies depending on local customs.

The Importance of Title Protection There are many title issues that could cause you to lose your real property or your mortgage investment. Even the most careful search of public records may not disclose the most dangerous threat: hidden risks. These issues may not be uncovered until years later. Without title insurance from a reputable and financially solvent company, the ownership of your home could be jeopardized.

Here are some examples of title issues that may occur:

- Deeds by persons supposedly single, but secretly married

- Deeds in lieu of foreclosure given under duress

- Marital rights of spouse purportedly, but not legally, divorced

- Impersonation of the true owner of the land Deeds by minors

- Deeds by persons of unsound mind

- Deeds to or from defunct corporations

- Defective acknowledgments by notaries

- Duress in execution of instruments

- Erroneous reports furnished by tax officials

- Forged deeds, releases, etc.

- Mistakes in recording legal documents

- Surviving children omitted from will

- Administration of estate of persons absent but not deceased Birth or adoption of children after date of will

- Claims of creditors against real property sold by heirs or devisees Deed of community proper

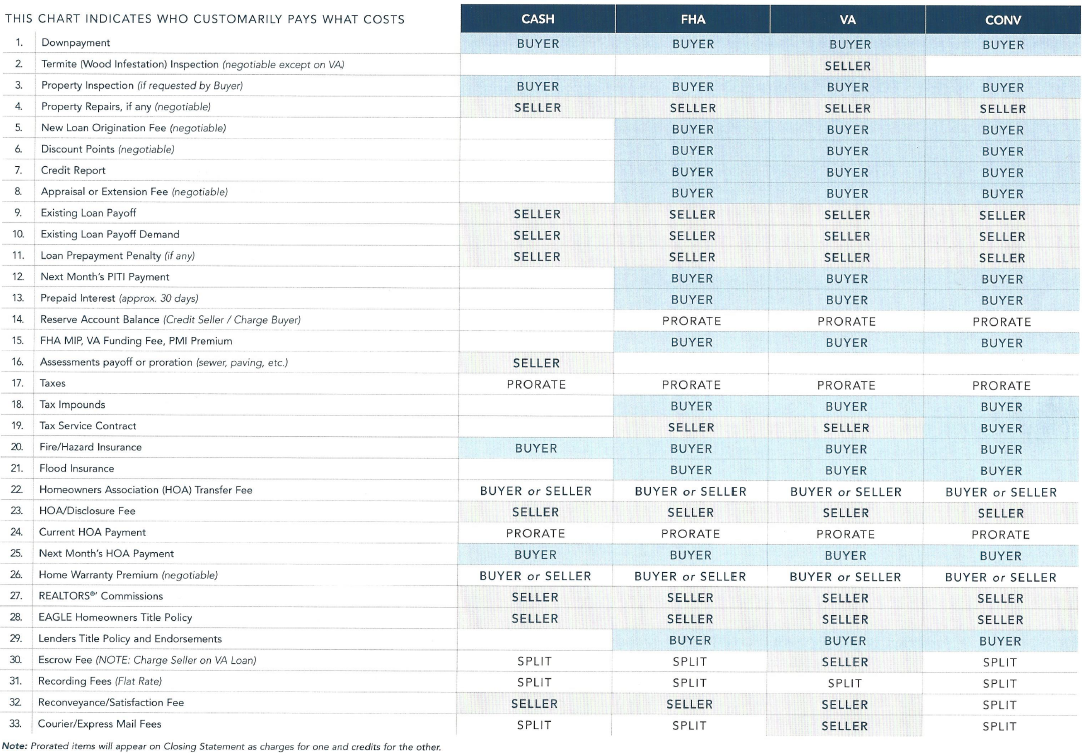

Closing Costs- what are the numbers?

How to Close Escrow

THE CLOSING DISCLOSURE

Once the loan is approved and all invoices and paperwork have been provided, the lender and escrow officer will collaborate on the preparation of the Closing Disclosure (CD). In order to close on time, all paperwork and invoices should be submitted at least 10 days prior to the expected close of escrow date. The borrower must receive the CD at least three days* prior to consummation of the loan (typically the signing date). The escrow officer will also prepare an estimated settlement statement and inform the buyer of the balance of the down payment and closing costs needed to close escrow.

THE CLOSING OR SIGNING APPOINTMENT

The escrow holder will contact you or your agent to schedule a closing or signing appointment. In some states, this is the “close of escrow.” In some others, the close of escrow is either the day the documents record or that funds are disbursed. Ask your escrow holder if you would like clarification about your state’s laws.

You will have a chance to review the settlement statement and supporting documentation. This is your opportunity to ask questions and clarify terms. You should review the settlement statement carefully and report discrepancies to the escrow officer. This includes any payments that may have been missed. You are responsible for all charges incurred even if overlooked by the escrow holder, so it’s better to bring these to their attention before closing.

The escrow holder is obligated by law to have the designated amount of money before releasing any funds. If you have questions or foresee a problem, let your escrow holder know immediately.

DON’T FORGET YOUR IDENTIFICATION

You will need valid identification with your photo I.D. on it when you sign documents that need to be notarized (such as a deed). A driver’s

license is preferred. You will also be asked to provide your social security number for tax reporting purposes, and a forwarding address.

WHAT HAPPENS NEXT?

If you are obtaining a new loan, your signed loan documents will be returned to the lender for review. The escrow holder will ensure that all contract conditions have been met and will ask the lender to “fund the loan.” If your loan documents are satisfactory, the lender will send funds directly to the escrow holder. When the loan funds are received, the escrow holder will verify that all necessary funds are in. Escrow funds will be disbursed to the seller and other appropriate payees. Then, you’ll receive the keys to your home!

After The Closing

We recommend you keep all records pertaining to your home together in a safe place, including all purchase documents, insurance, maintenance, and improvements.

HOME WARRANTY REPAIRS

If you have a home warranty plan with First American Home Buyers Protection, please call them directly and have your home warranty number available.

RECORDED DEED

The original deed to your home will be mailed directly to you by the County Recorder, generally within four to six weeks.

TITLE INSURANCE POLICY

First American Title will mail your policy to you in about two to three weeks.

PROPERTY TAXES

You may not receive a tax statement for the current year on the home you buy; however, it is your obligation to make sure the taxes are paid when due. Check with your mortgage company to find out if taxes are included with your payment. For more information on your property taxes, visit your County Auditor/Controller’s web site.

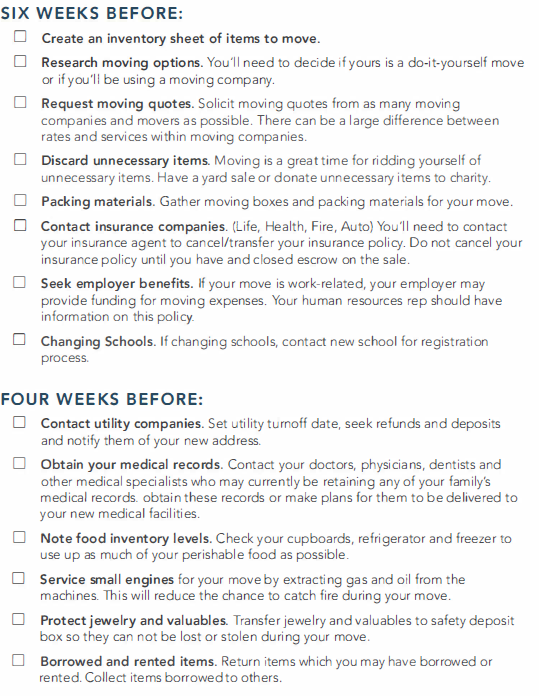

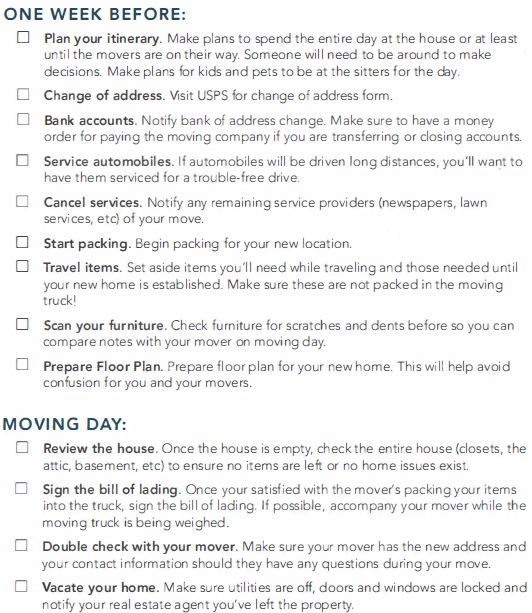

Planning Your Move

Signing Day!

- So now you’ve gone through almost the entire process and it’s finally the big day!

- You may actually sign your documents in advance of closing day. You will go to the Title company, or they will send a notary to you. You will hand them a check for whatever fees you owe (you will know that in advance). You will have your driver’s license so the notary can record your official signatures.

- Usually around 5pm on the actual COE day, the Title will record so the property is officially in your name, and all of the funds get dispersed. All of the costs outlined above get settled.

Content provided by First American Title. ©First American Title Corporation and/or its affiliates. All rights reserved.