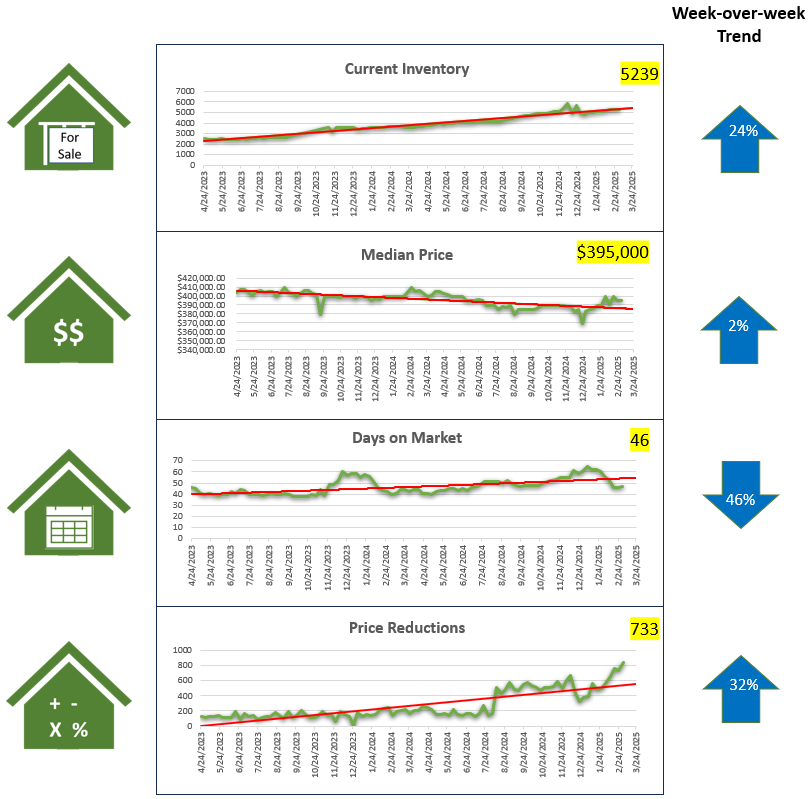

What’s available today

“What’s Available Today” data is a snapshot of what is available to purchase today- This is a “forward view” trend

Available inventory continues to increase to levels not seen in several years, while price reductions are escalating considerably. Accordingly, prices are drawing back slightly while the time a home is on the market remains in the mid-40 day range. And yet we are still seeing some homes hit the market and get under contract is just days! Those homes tend to be move-in ready, updated, vacant and reasonably priced. Homes that need updating or are not in tip top shape tend to linger on the market.

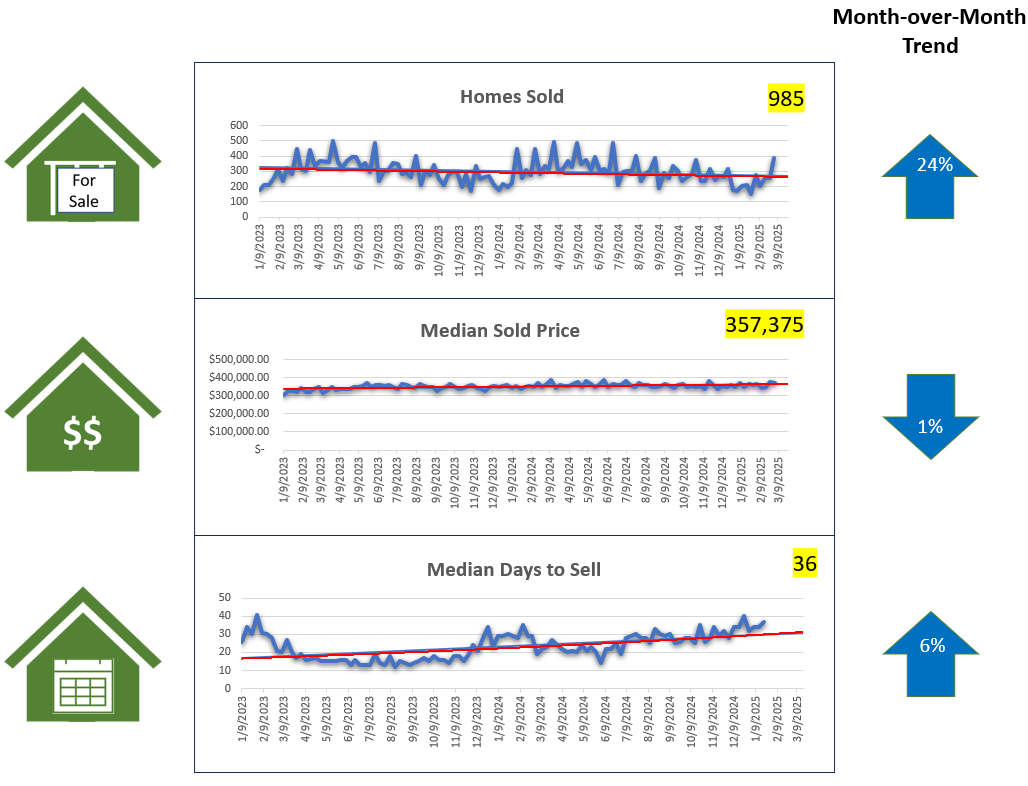

What sold last month

“What sold” data is a view of what sold during the past month- This is a “rear view” trend

The number of homes sold is predictably ticking up as we enter the spring season. Meanwhile, median price has remained pretty flat over the past year.

From the lender’s perspective:

It seems the expectation for mortgage rates this coming year to depend on jobs data and inflation. Worst case scenario: If coming jobs report is stronger than expected and inflation remains elevated, then the coming year will look a lot like the past 2 years; flat. Best case: a softer economic data report will be good for rates.

What I think of our market future:

What we’re NOT seeing is a long term pricing crater. Homes that are what the buyer is looking for; good shape, move-in ready without a lot of work and in the right area are selling at or near asking price. But there’s not a ton of buyers yet, so homes that are not quite ticking the boxes and/or need updating or some work to meet expectations are languishing a bit longer on the market and selling for less than asking. After the crazy price increases we saw during the pandemic, there was fear that we were on a bubble that would eventually burst. Prices would fall way back and millions of new homeowners would be upside down causing a foreclosure crisis. None of that happened because none of the bubble factors existed. We survived and the housing market that kept the economy afloat during really bad economic times looks to be holding strong as the rest of the markets catch up.

Asia and I track numerous data points that are great indicators of what’s happening in the Tucson market. This enables us to stay in front of local trends and guide our clients through what can be turbulent waters. We also connect with several industry experts who provide unique analysis of the broader national housing market as it is important to understand where Tucson fits into the overall landscape.

~ Doug Deck, REALTOR- ABR, MRP, SRES